Confirming Residency

The Process Server's Responsibility

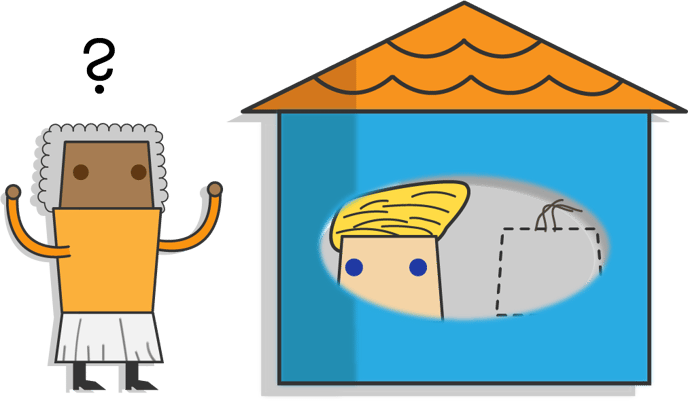

Though we are very good at serving people documents, it is often not at the first address that we try. Confirming residency is an important responsibility for process servers, because we need to determine every time if we have the right address. We can't move on from an initial address until we know the servee doesn't live there, and we can't legally substitute serve or post the documents until we know that they do as well. we are very good at serving people documents, it is often not at the first address that we try. Confirming residency is an important responsibility for process servers, because we need to determine every time if we have the right address. We can't move on from an initial address until we know the servee doesn't live there, and we can't legally substitute serve or post the documents until we know that they do as well.

This is the reason this confirmation is entirely your responsibility, unless explicitly stated otherwise in the Special Handling notes. Confirmation of residency is determined through conversation with a co-resident, neighbor, or leasing office personnel.

Imagine you get documents for Jeff Mann at 1234 Living Person Road. Jeff is not available, but Alsoa Mann answers the door. The best question to ask is full and direct:

"Does Jeff Mann live here with you?"

If the answer is yes, then do what makes sense for your state in that situation - either make an attempt adding "subject resides but not available at this time," or perform substitute service if the circumstances allow.

Special Handling Confirmation

Sometimes people will lie about who they know, where someone lives, or whether they can accept service documents. In these cases, the special handling notes are there to help. Sometimes our customers will have definite knowledge of the defendant's whereabouts, and request that you serve papers no matter what a resident tells you.

When you are expected to serve documents regardless of what the person at the door says (e.g. "No, Jeff Mann does not live here. He moved away"), then the special handling notes will very explicitly state these expectations. Oftentimes, the phrase "serve regardless" is used.

Special Handling Assistance

At ABC Legal, we have a skip-trace team staffed by licensed private investigators. They are always striving to determine the best address for service. Sometimes you will find yourself in the following situation: You went to 4321 Very Long Rd, and spoke with Genoa Mann who was very polite and forthcoming with information. Genoa Mann told you that Venice Mann moved out 3 years ago and they are unfortunately not on speaking terms.

After diligent review, (our investigators have their own diligence requirements), the investigations team has determined it is very likely that Venice Mann does reside at 4321 Very Long Rd. You are now asked to make further service attempts at a residence that you had previously marked with Non-Residency Indicators - but this time you should be armed with more information.

Our investigations team will provide you with all the evidence pointing to the validity of the address in the special handling notes upon return. If you receive special handling notes from our investigations team, it is meant only to be treated as supporting evidence to assist you in the service. It is not intended to be taken as confirmation of residency.

Types of Special Handling Assistance

Owner of service address:

Address on SSN records:

Recently Reported Address: Our investigations team gathers dozens of records to form a cohesive narrative of the individual's history. "This address was most recently reported" means that the individual has not told any official entities that they are living at a new home.

Vehicle Registration: Most states require that your vehicle be registered to your home address, and that this information be updated when you move. If a defendant's vehicle is registered to an address, there is a very good chance that they live there. If it's parked in the driveway, it's very likely that they are home.

Driver's License Registration: Similar to vehicles, a lot of states require that the address on your license is updated when you move.

Homestead Exemption: Possibly the strongest evidence in favor of a person's address. A Homestead Exemption is a protection on part of a property's value, preventing it from being fully taxable. A person may not claim a Homestead Exemption on more than one property at a time, and the IRS requires that it be their primary residence to receive this special tax exemption.